Sage Fixed Assets (Formerly "Sage FAS")

Fixed Asset Management Software Overview

For many companies, their largest capital investment is in fixed assets like property, plant, and equipment. With complex tax rules, changing compliance requirements, and assets coming in and out of service all the time, managing fixed assets can be a moving target.

And if you're tracking fixed assets manually or in spreadsheets, you already know that manual adjustments and data entry can be time-consuming and cause costly errors.

If that sounds all too familiar, then it may be time to consider Sage Fixed Assets.

See Also:

And if you're tracking fixed assets manually or in spreadsheets, you already know that manual adjustments and data entry can be time-consuming and cause costly errors.

If that sounds all too familiar, then it may be time to consider Sage Fixed Assets.

See Also:

- Sage Fixed Assets 2024 (What's New)

- Sage Fixed Assets User Guide

Features and Benefits of Sage Fixed Assets

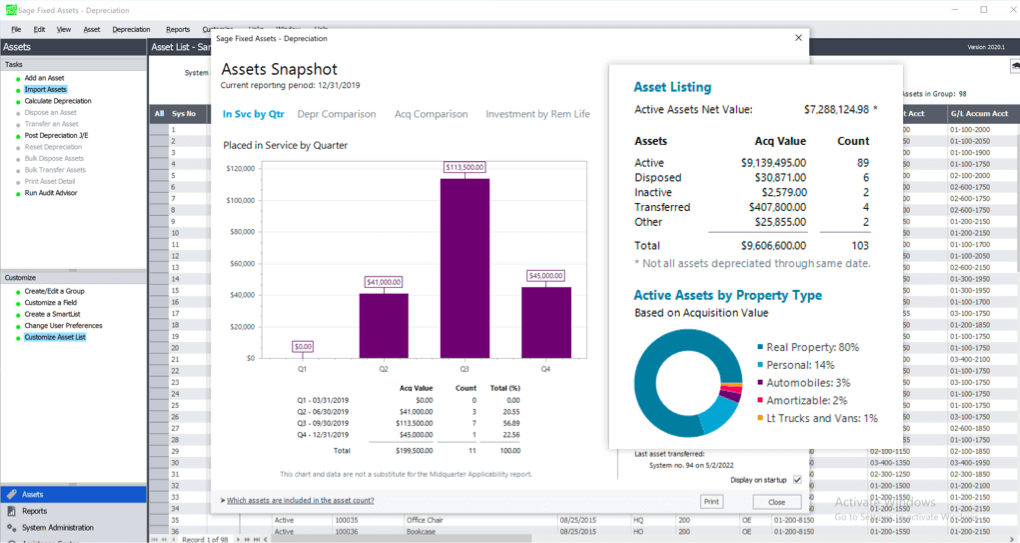

Sage Fixed Assets automates your entire fixed asset process from acquisition to disposal. Not only does it save time and improve accuracy, Sage Fixed Assets can help you recover from a disaster, stay compliant with federal regulations, and prevent you from overpaying on taxes and insurance.

Depreciation:

Enjoy simplified fixed asset tracking with comprehensive depreciation calculations including over 300,000 U.S. and Canadian regulations for businesses, governments, and nonprofits. Sage Fixed Assets—Depreciation offers more than 50 depreciation methods including MACRS 150 percent and 200 percent (formulas and tables), ACRS, Straight-Line, Modified Straight-Line (formulas and tables), Declining Balance, Sum-of-the-Years-Digits, and user-defined depreciation methods.

Tracking:

Conduct thorough physical inventories of your fixed assets with an easy graphical step-by-step process and state-of-the-art mobile devices. You can conduct multiple inventories concurrently at various sites and reconcile data at one central location.

Planning:

Take control of your fixed assets before they even become fixed assets with flexible management of capital budgeting and construction-in progress projects. Whether you're assembling multi-component equipment, upgrading machinery, renovating buildings, or just accumulating separate invoices prior to placing a fixed asset into service, Sage Fixed Assets—Planning is the perfect solution to your construction in progress needs.

Reporting:

Create an endless variety of custom reports, including charts, graphs, and advanced formatting options. With Sage Fixed Assets-Reporting, you gain total control over the format, appearance, and context of all your depreciation and asset management reports.

Depreciation:

Enjoy simplified fixed asset tracking with comprehensive depreciation calculations including over 300,000 U.S. and Canadian regulations for businesses, governments, and nonprofits. Sage Fixed Assets—Depreciation offers more than 50 depreciation methods including MACRS 150 percent and 200 percent (formulas and tables), ACRS, Straight-Line, Modified Straight-Line (formulas and tables), Declining Balance, Sum-of-the-Years-Digits, and user-defined depreciation methods.

Tracking:

Conduct thorough physical inventories of your fixed assets with an easy graphical step-by-step process and state-of-the-art mobile devices. You can conduct multiple inventories concurrently at various sites and reconcile data at one central location.

Planning:

Take control of your fixed assets before they even become fixed assets with flexible management of capital budgeting and construction-in progress projects. Whether you're assembling multi-component equipment, upgrading machinery, renovating buildings, or just accumulating separate invoices prior to placing a fixed asset into service, Sage Fixed Assets—Planning is the perfect solution to your construction in progress needs.

Reporting:

Create an endless variety of custom reports, including charts, graphs, and advanced formatting options. With Sage Fixed Assets-Reporting, you gain total control over the format, appearance, and context of all your depreciation and asset management reports.

Why Companies Choose Sage Fixed Assets

- Sage Fixed Assets is used by the Big Four accounting firms

- Companies choose the popular fixed assets software 3-to-1 over all other competing solutions combined

- The software easily integrates with your General Ledger solution

- Sage has more than 20 years of service and support

- Sage Fixed Assets has over 100,000 users nationwide

Fixed Assets: The Big Picture from Sage

Watch this short video to learn what Sage Fixed Assets can do for you and your business.

Watch this short video to learn what Sage Fixed Assets can do for you and your business.

NEED HELP WITH SAGE FIXED ASSETS?

CLICK BELOW TO FIND A SAGE FIXED ASSETS AUTHORIZED PARTNER TO REQUEST A DEMO, PRICING, OR SUPPORT

|