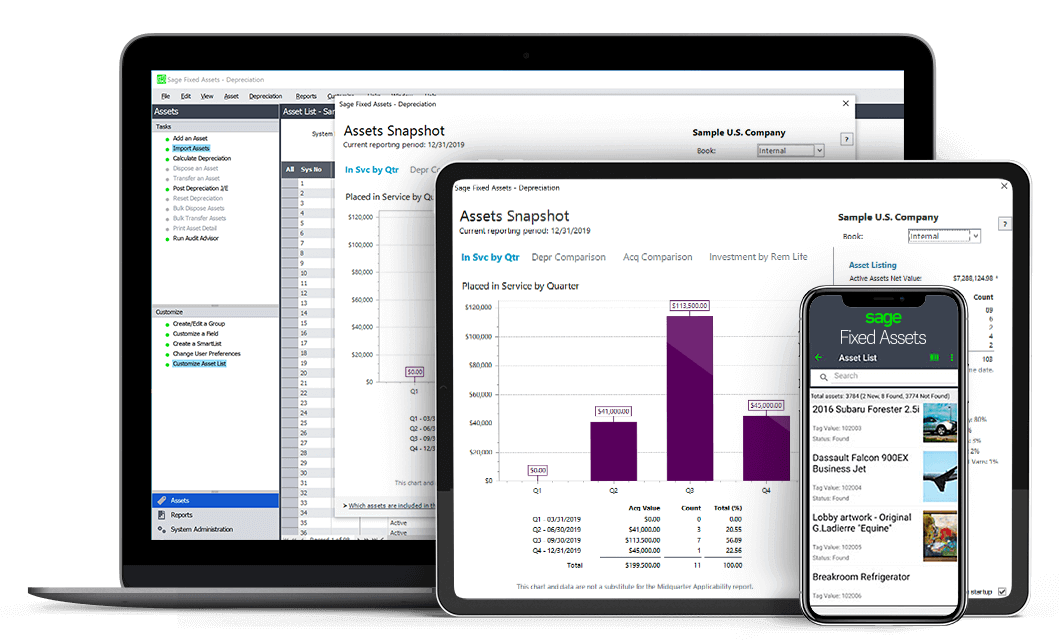

Sage Fixed Assets 2024 is now available featuring enhancements that improve asset maintenance tracking, streamline asset tax reporting, a new customer portal to submit your enhancement ideas, and more. Here’s a quick look at what’s new.

Asset Tax Reporting Enhancements

Sage Fixed Assets-Deprectiation boosts efficiency by allowing you to save multiple report definitions for Form 4562, Form 4797 worksheet, Section 199A Report, and the Mid-quarter Applicability reports. This new feature lets you specify each report's groups, books, and run dates, streamlining your workflow. Plus, you can now add each report to a batch in Batch Reports, significantly reducing the time spent on individual processing.

What’s more, Sage Fixed Assets—Reporting has been upgraded to the latest version of SAP® Crystal Reports, 2020. This upgrade takes advantage of the latest technology, performance improvements, and features in Crystal Reports.

Lastly, you can now do things in your own time with no need to wait for our annual tax update release. That’s because the Sage Fixed Assets 2024 release enables you to run Form 4562 for tax years 2022 and 2023 as file-able forms.

What’s more, Sage Fixed Assets—Reporting has been upgraded to the latest version of SAP® Crystal Reports, 2020. This upgrade takes advantage of the latest technology, performance improvements, and features in Crystal Reports.

Lastly, you can now do things in your own time with no need to wait for our annual tax update release. That’s because the Sage Fixed Assets 2024 release enables you to run Form 4562 for tax years 2022 and 2023 as file-able forms.

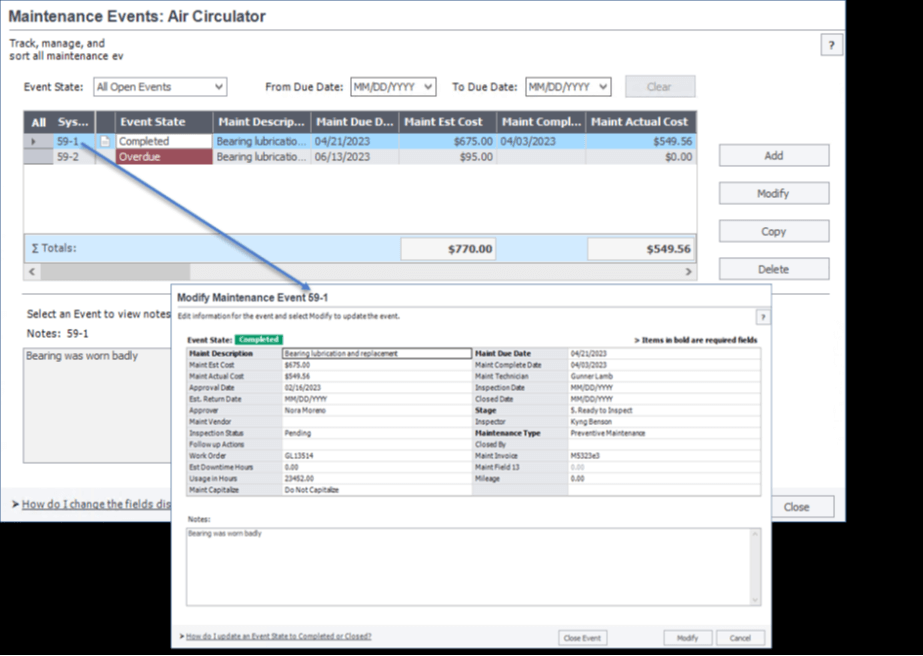

Fixed Asset Maintenance

Available in Sage Fixed Assets—Tracking, this new feature enables collaboration across the accounting and maintenance teams. It has the flexibility you need to control every aspect of asset maintenance, with 26 customizable fields and time-saving SmartLists. You can also create multiple Maintenance Events per asset, track cumulative maintenance and repair costs throughout an asset’s lifespan, and establish and monitor maintenance.

Submit Your Product Ideas

As a Sage Fixed Assets customer, viewing and submitting product ideas is more accessible with the new Sage Fixed Assets Ideas Portal on the web. Or to access this feature within the software, navigate to Help >> Submit a Product Idea.

Using the Customer Ideas Portal, you can submit new ideas for product improvement, view submissions that others have created, and even vote on existing ideas to help boost the likelihood of that idea making into a future software release – all of which empowers you to actively participate in shaping the future of the Sage Fixed Asset product.

Using the Customer Ideas Portal, you can submit new ideas for product improvement, view submissions that others have created, and even vote on existing ideas to help boost the likelihood of that idea making into a future software release – all of which empowers you to actively participate in shaping the future of the Sage Fixed Asset product.

Sage Fixed Assets 2024.1 Product Update

Following the original release of Sage Fixed Assets 2024 late last year, product update 1 (2024.1) is now available as of January 2024. Version 2024.1 contains important tax compliance updates for section 179 deductions and IRS form 4562, integration with Sage Intacct Purchasing module, streamlined data entry for QIP assets, and an integrated AI chatbot called Sage Fixed Assets Ally that can answer your questions quickly right within the software.

Upgrading to Sage Fixed Assets 2024

Contact your Sage Partner if you need help with an upgrade to 2024/2024.1 or to request a copy of the Sage Fixed Assets 2024 release notes that explains all new or enhanced software features in detail as well as bugs/errors addressed in each release.