While the role of a credit manager is variable in its scope, he or she is usually charged with managing the credit department and make decisions concerning credit limits, acceptable levels of risk, and terms of payment to their customers – in other words, reducing bad debt and collecting on customer invoices due. In this article, we’ll examine 3 metrics that are critical in helping credit mangers do just that.

Credit Managers Primary Responsibility

Before we get dive into a discussion about detailed reports and metrics, it’s helpful to review the primary role and responsibility of a credit manager.

Collecting debt from customers can be a difficult task and the collections process isn’t something many people look forward to. It’s easy to push it off and kick the can down the road. But the longer an invoice goes unpaid, the less likely you are to collect payment.

The key is to proactively manage accounts receivable and process customer payments before things get to the collections stage.

Following are key metrics that credit managers should track in order to do that.

- Controlling bad debt exposure and expenses through the direct management of credit terms on the company's ledgers.

- Maintaining strong cash flows through efficient collections. The efficiency of cash flow is measured using various methods, most common of which is Days Sales Outstanding (DSO).

- Ensuring an adequate Allowance for Doubtful Accounts is kept by the company.

- Monitoring the Accounts Receivable portfolio for trends and warning signs.

- Setting credit limits.

- Setting credit-rating criteria.

- Setting and ensuring compliance with a corporate credit policy.

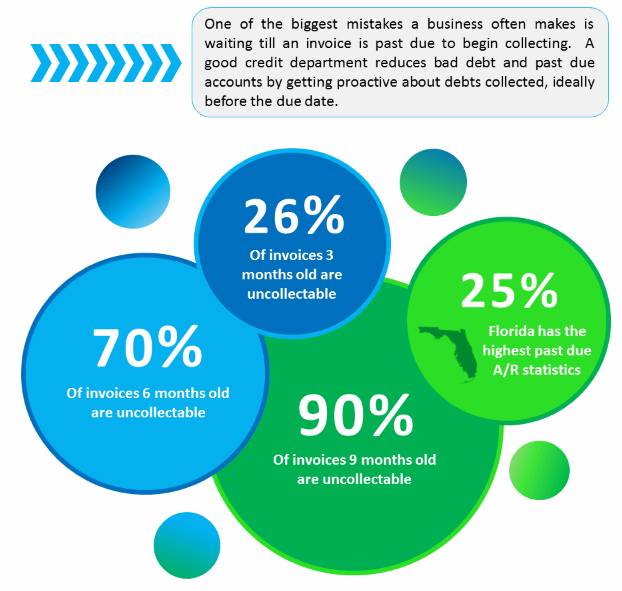

Collecting debt from customers can be a difficult task and the collections process isn’t something many people look forward to. It’s easy to push it off and kick the can down the road. But the longer an invoice goes unpaid, the less likely you are to collect payment.

The key is to proactively manage accounts receivable and process customer payments before things get to the collections stage.

Following are key metrics that credit managers should track in order to do that.

1. Monitor Days Sales Outstanding (DSO)

DSO indicates the average number of days it takes your company to collect funds after a sale has been made. The lower the DSO, the more cash is available for the business to reinvest in marketing, sales and operations.

For many businesses, reducing DSO can be a big challenge. But the upside benefit of increased cash flow and additional funds for growth can be worth the effort. One simple method to reducing DSO is converting paper to email with electronic invoicing, which also reduces labor and material costs. Businesses can often reduce the collection cycle by 2-6 days after implementing electronic invoicing.

Another strategy includes sending triggered reminder letters. In most situations, customers don’t consciously decide to avoid paying an invoice – they simply forget. This is the major challenge associated with reducing DSO. Electronic invoicing and reminder emails can greatly assist in overcoming this challenge.

For many businesses, reducing DSO can be a big challenge. But the upside benefit of increased cash flow and additional funds for growth can be worth the effort. One simple method to reducing DSO is converting paper to email with electronic invoicing, which also reduces labor and material costs. Businesses can often reduce the collection cycle by 2-6 days after implementing electronic invoicing.

Another strategy includes sending triggered reminder letters. In most situations, customers don’t consciously decide to avoid paying an invoice – they simply forget. This is the major challenge associated with reducing DSO. Electronic invoicing and reminder emails can greatly assist in overcoming this challenge.

2. Track Write-Offs

Write-offs occur upon the realization that an asset, in this case accounts receivable, can no longer be converted into cash or provide further use to the business. Receivables cannot be written off until collection efforts have ceased.

If an account is more than six months old, the likelihood of payment without a collection agency or lawsuit decreases substantially. According to The Accounting Minute by Sutherland, the percentage of outstanding invoices will not be paid:

Minimizing write-offs is a key component in improving cash flow. The smaller the write-off amount is, the happier the business remains. This means the faster you can reduce the write-off amount, the better off everyone will be.

If an account is more than six months old, the likelihood of payment without a collection agency or lawsuit decreases substantially. According to The Accounting Minute by Sutherland, the percentage of outstanding invoices will not be paid:

- 26% of invoices 3 months old are uncollectable

- 70% of invoices 6 months old are uncollectable

- 90% of invoices 12 months old are uncollectable

Minimizing write-offs is a key component in improving cash flow. The smaller the write-off amount is, the happier the business remains. This means the faster you can reduce the write-off amount, the better off everyone will be.

3. Assess Credit Risk

Your customers make up your portfolio of business. With a portfolio, comes credit risk. We’ve all had customers with a history of paying on time and those customers that pay, but they pay late. The key to keeping a healthy cash flow and low DSO is to isolate the late payers. Consistently late payers should have different credit limits and collection strategies applied to their accounts in order to reduce risk. Carefully monitor payment trends with aging reports and implement a credit rating system to reduce overall credit risk.

The most common way businesses track credit worthiness is to pull customer credit ratings from a credit-monitoring firm. There are many credit-monitoring firms our there; such as Dun and Bradstreet, Experian, or Equifax to name a few. These firms allow you to check credit on an individual business, a subset of or your entire customer portfolio. If you want your customers’ credit rating updated on demand and available immediately for credit worthiness decisions, select a credit –monitoring firm that integrates with your account receivable or collections software system.

One of the oldest and largest credit-monitoring firms is NACM National Trade Credit Report. The NACM National Trade Credit Report gives you a predictive score and risk rating on demand through your account receivable or collections software. An accurate picture of how a customer pays is needed to make the credit and credit limit decisions to reduce credit risk and increase your chance of payment.

The most common way businesses track credit worthiness is to pull customer credit ratings from a credit-monitoring firm. There are many credit-monitoring firms our there; such as Dun and Bradstreet, Experian, or Equifax to name a few. These firms allow you to check credit on an individual business, a subset of or your entire customer portfolio. If you want your customers’ credit rating updated on demand and available immediately for credit worthiness decisions, select a credit –monitoring firm that integrates with your account receivable or collections software system.

One of the oldest and largest credit-monitoring firms is NACM National Trade Credit Report. The NACM National Trade Credit Report gives you a predictive score and risk rating on demand through your account receivable or collections software. An accurate picture of how a customer pays is needed to make the credit and credit limit decisions to reduce credit risk and increase your chance of payment.

Collect Payments and Beat Bad Debt

It’s no secret that collecting accounts receivable has its fair share of unique challenges. However, overcoming these challenges becomes systematic once you’ve found an effective system for tracking the metrics and implementing collection strategies.

One proven method is the use of an accounts receivable and collections system. This system should organize, categorize, and report the data so that tracking DSO, aging invoices, monitoring high-risk customers is automatic. With a system in place, you can be proactive in your collections process and improve cash flow.

In addition to providing accounts receivable metrics for analysis, a collections system should offer tools to automate mundane, repetitive tasks. A collections system should automatically highlight the accounts that need attention and schedule reminders, letters, and calls for those accounts. Because being proactive with your collections process will improve cash flow, reduce bad debt, and make your business better.

One proven method is the use of an accounts receivable and collections system. This system should organize, categorize, and report the data so that tracking DSO, aging invoices, monitoring high-risk customers is automatic. With a system in place, you can be proactive in your collections process and improve cash flow.

In addition to providing accounts receivable metrics for analysis, a collections system should offer tools to automate mundane, repetitive tasks. A collections system should automatically highlight the accounts that need attention and schedule reminders, letters, and calls for those accounts. Because being proactive with your collections process will improve cash flow, reduce bad debt, and make your business better.

|

Guest Post by Dynavistics, Inc.

This article was provided by Dynavistics, Inc. The company's innovative add-on software solutions - like Collect-IT - will transform your “I wish I could” into “I know we can” by enhancing your existing ERP software so it's capable of doing more than you ever thought possible. Their solutions for wholesale distribution, A/R collections, delivery management, and more integrate with popular ERP applications including Sage and Microsoft Dynamics. |

|