In Sage 100, you can’t post an out of balance journal entry in the general ledger. Total debit entries must equal the total credit entries. Here are some tips and a video tutorial that will show you how to correct an out-of-balance journal entry before updating the general ledger in Sage 100.

Out of Balance in the Current Period

You can recall and modify journal entries at any time until you complete the update process. To recall a journal entry you have previously entered, click the list entries button to modify the journal entry.

However if the update process has already been completed, you must record an adjusting entry to correct the mistake.

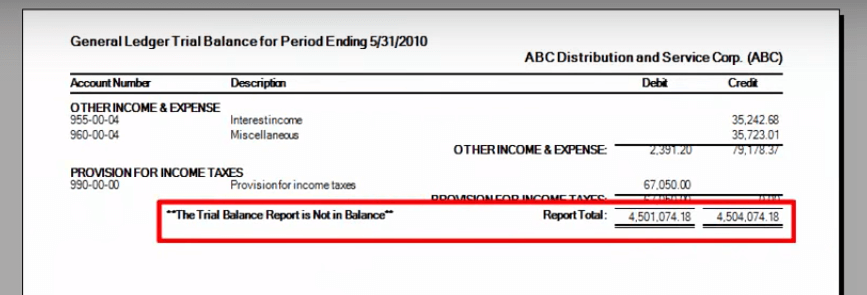

When printing a trial balance for all accounts, the totals at the beginning balance and ending balance columns for the report total should equal zero. The debits and credits should display the same amounts.

If these conditions are not met, general ledger is out of balance.

You can also view on the general ledger detail report or the general ledger detail by source report to verify the out of balance situation.

NOTE: there are also some very unique situations where you need to use the one-sided entry feature to correct an out-of-balance entry. In this case, you must have your user logon set up with a role assigned with the proper security rights assigned in order to post out of balance entries.

When you review your general ledger trial balance (choosing the “ending balance only” in the report options screen), you can go to the end of the report and see that it is not in balance. You’ll notice that the debits and credits do not equal.

However if the update process has already been completed, you must record an adjusting entry to correct the mistake.

When printing a trial balance for all accounts, the totals at the beginning balance and ending balance columns for the report total should equal zero. The debits and credits should display the same amounts.

If these conditions are not met, general ledger is out of balance.

You can also view on the general ledger detail report or the general ledger detail by source report to verify the out of balance situation.

NOTE: there are also some very unique situations where you need to use the one-sided entry feature to correct an out-of-balance entry. In this case, you must have your user logon set up with a role assigned with the proper security rights assigned in order to post out of balance entries.

When you review your general ledger trial balance (choosing the “ending balance only” in the report options screen), you can go to the end of the report and see that it is not in balance. You’ll notice that the debits and credits do not equal.

Getting Things Back in Balance

If posting a correcting journal entry to reverse the mistake is not an option, you may need to use the one-sided journal entry function.

Here’s how to correct things:

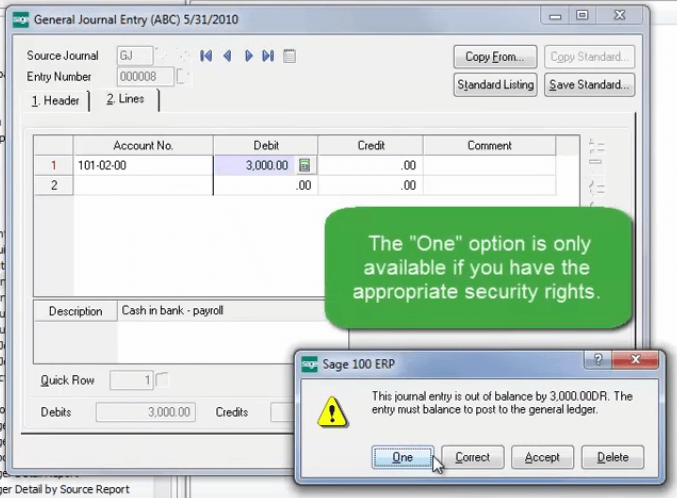

1. Go to general journal entry, select a source journal, and assign the next entry number.

2. Choose a G/L account number and enter the appropriate amount in the debit or credit field.

3. Click Accept

Immediately, you’ll see a popup warning that reads as follows:

“This journal entry is out of balance by $X,XXX.XX. The entry must balance to post to the general ledger.”

The available options on the popup include:

Here’s how to correct things:

1. Go to general journal entry, select a source journal, and assign the next entry number.

2. Choose a G/L account number and enter the appropriate amount in the debit or credit field.

3. Click Accept

Immediately, you’ll see a popup warning that reads as follows:

“This journal entry is out of balance by $X,XXX.XX. The entry must balance to post to the general ledger.”

The available options on the popup include:

- Correct – which allows you to modify the entry and correct it.

- Accept – saves the entry so that you can research the issue and fix it later.

- Delete – remove the entry completely.

- One – this allows you to post a one-sided journal entry (available only if you have the proper user credentials)

4. Choose the One option, post the entry, and update the general journal.

As a last step, check your general ledger trial balance, go to the last page, and verify that debits equal credits and voila – you’re back in balance!

As a last step, check your general ledger trial balance, go to the last page, and verify that debits equal credits and voila – you’re back in balance!

Out of Balance in the Current Period

In situations where the out-of-balance occurred in a prior period, you’ll need to print the trial balance report and review the total line. You may need to do that several times for prior periods until you find a trial balance report with the beginning balance total at zero.

You'll print the trial balance report for all accounts including beginning balance activity and ending balances, and then you can print the general ledger “detail by source” report to help you identify the out the out-of-balance entry.

You’ll want to print the report for all journals, all batches, and for the date range of the period that’s out of balance. After you've located the out-of-balance entry, you can refer to the original register to determine what portion of the entry is incorrect.

It's very similar to the current period adjustment we walked through earlier in the article, but going back period by period until you find a beginning balance of zero, apply your appropriate entries, and then making that correction.

You'll print the trial balance report for all accounts including beginning balance activity and ending balances, and then you can print the general ledger “detail by source” report to help you identify the out the out-of-balance entry.

You’ll want to print the report for all journals, all batches, and for the date range of the period that’s out of balance. After you've located the out-of-balance entry, you can refer to the original register to determine what portion of the entry is incorrect.

It's very similar to the current period adjustment we walked through earlier in the article, but going back period by period until you find a beginning balance of zero, apply your appropriate entries, and then making that correction.