Each month, like clockwork, bank statements and canceled checks arrive, setting off a tedious and time-consuming reconciliation process that’s vital to ensure the accuracy of your accounting data. But luckily, this process is now a lot easier and more automated with recent enhancements to the bank reconciliation module in Sage 100. Here’s a closer look.

Automated Bank Reconciliation

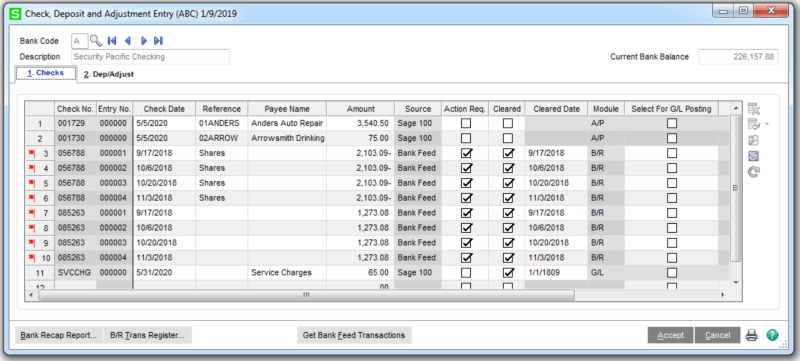

As of Sage 100 Version 2018.5, the Bank Reconciliation module now automates and simplifies the monthly reconciliation process, detects unrecorded transactions between books and banks, locates errors or differences, records corrections, and reconciles your books to bank statements.

Among many other features, the Bank Reconciliation module enables the use of multiple bank accounts, automatic and manual posting of checks, adjustments and deposits, quick and easy account reconciliation, complete transaction listings and details, and more.

Among many other features, the Bank Reconciliation module enables the use of multiple bank accounts, automatic and manual posting of checks, adjustments and deposits, quick and easy account reconciliation, complete transaction listings and details, and more.

Sage Bank Feeds

Sage Bank Feeds is an important component in the newly-streamlined process which allows Sage 100 to connect directly with your bank and automate transaction matching which not only eliminates manual entry and potential human error, it also flags discrepancies as they happen. You can connect your financial institutions to Sage 100 in Bank Maintenance when you access the task through the Bank Reconciliation menu. A wizard walks you through the process.

Bank Reconciliation Key Features

Key features of the new and improved Bank Reconciliation process include:

Perhaps equally important, Sage 100 Bank Reconciliation gives you insights behind the numbers to better manage and direct cashflow activites with built-in reports, and analysis. You can even project estimated cashflow when you link it to your Accounts Receivable, Accounts Payable, Payroll, and Purchase Order modules.

- Multiple Bank Accounts – Up to 36 separate bank accounts can be established for a single company and transactions can be automatically posted from GL, AR, AP and Payroll.

- Automated Reconciliation - Displayed monthly activity enables you to reconcile bank accounts quickly and easily. Transactions can be confirmed as cleared using a single keystroke.

- Bank Reconciliation Register - All transactions, cleared and outstanding, are listed on this detailed report for each bank account. The Reconciliation Summary shows the adjusted bank balance, computer-calculated book balance, and any out-of-balance amount.

Perhaps equally important, Sage 100 Bank Reconciliation gives you insights behind the numbers to better manage and direct cashflow activites with built-in reports, and analysis. You can even project estimated cashflow when you link it to your Accounts Receivable, Accounts Payable, Payroll, and Purchase Order modules.

Ready to Automate Your Bank Reconciliation Process?

Click below to get in touch with a local Sage 100 Consultant in your area that can answer your questions about bank reconciliation, provide assistance connecting Sage Bank Feeds to your financial institution, or help upgrade your Sage 100 system to unlock the new features.