Key Highlights from the Latest Release Notes

Sage Intacct 2022 Release 4 is now available. With new features and enhancements from financial management and budgeting to time tracking and payroll, this final release of 2022 packs a powerful punch. Here’s a look at what’s new in Sage Intacct 2022 R4.

New in Budgeting and Planning

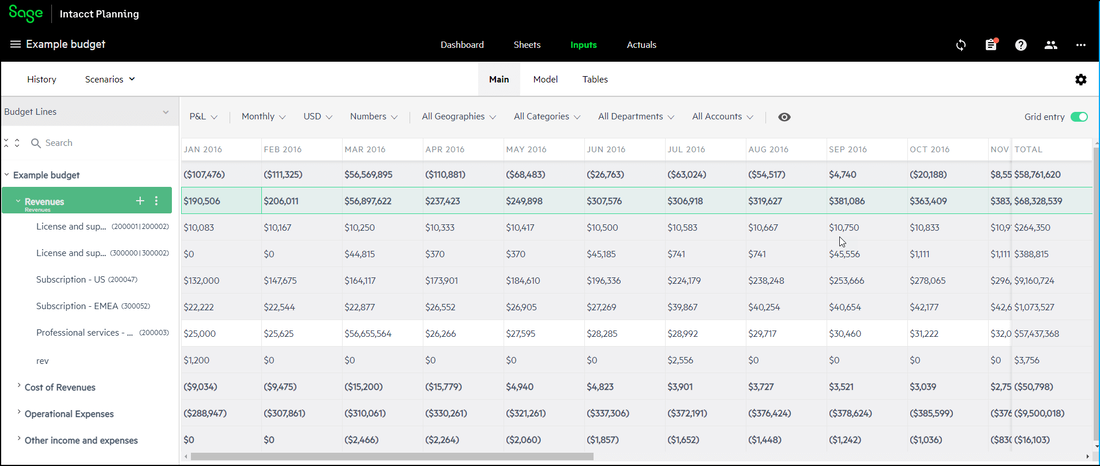

Sage Intacct Planning incorporates two highly-requested features including Grid Entry and Statistical Accounts.

With Statistical Accounts, you can track operational metrics using non-monetary data such as head count, units shipped or square footage. This new feature allows you to combine operational data with financial data for deeper insights in your financial reports.

For example, a statistical account can be established for employee headcount in a particular department. You can then use this statistical account to allocate the total amount of expenses in a GL account for a given timeframe amongst various departments, such as allocating rent expenses for different departments by headcount.

Grid Entry incorporates an Excel-style interface that makes it even faster and easier to enter and adjust data ‘on the fly’, in a spreadsheet format that’s very familiar to most. Simply toggle the new ‘Grid Entry’ switch in the upper right-hand corner to switch between the new grid view and the SIP Form View.

With Statistical Accounts, you can track operational metrics using non-monetary data such as head count, units shipped or square footage. This new feature allows you to combine operational data with financial data for deeper insights in your financial reports.

For example, a statistical account can be established for employee headcount in a particular department. You can then use this statistical account to allocate the total amount of expenses in a GL account for a given timeframe amongst various departments, such as allocating rent expenses for different departments by headcount.

Grid Entry incorporates an Excel-style interface that makes it even faster and easier to enter and adjust data ‘on the fly’, in a spreadsheet format that’s very familiar to most. Simply toggle the new ‘Grid Entry’ switch in the upper right-hand corner to switch between the new grid view and the SIP Form View.

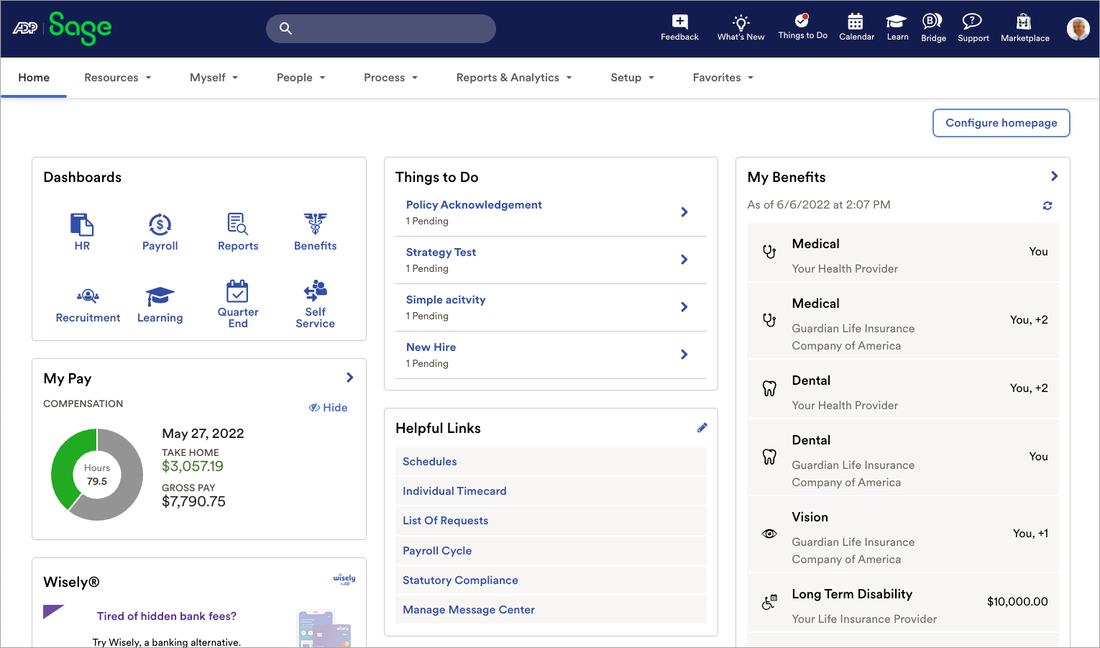

Introducing Sage Intacct Payroll Powered by ADP

Sage has partnered with Workforce Now by ADP to bring you a best-in-class payroll and human capital management (HCM) solution that integrates seamlessly with Sage Intacct. With this new capability, you can:

- Easily pay employees on-time, while avoiding errors fines with full-service payroll and built-in tax and compliance management.

- Reduce HR calls and backlogs with powerful employee self-service functionality

- Get detailed insights into labor costs, benefits usage, compensation, and attrition.

- Streamline your entire payroll process with out-of-the-box integration and GL entries that flow automatically to Sage Intacct.

Streamlined 1099 Filing

Just in time for year-end processing, Sage Intacct 2022 R4 now offers 1099 e-Filing capability that significantly reduces the hassle of printing paper-based 1099 forms and manually downloading and updating tax information. Leveraging Sage Digital Network Cloud Services, 1099 vendors and transactions in Sage Intacct seamlessly connect with TaxBandits – an IRS-authorized eFile provider – to validate 1099 information and submit the information to the IRS, state agencies, distributes forms to recipients.

Note: this new feature is available in limited release.

Note: this new feature is available in limited release.

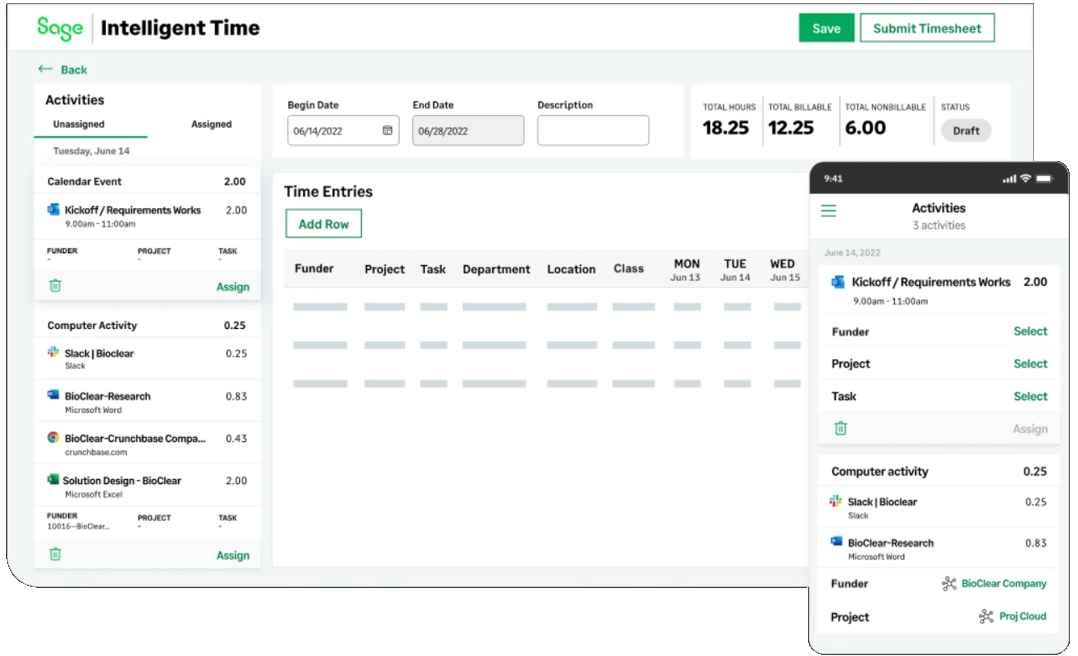

Better Time Tracking for Nonprofits

Sage Intelligent Time - an AI-powered time entry application - is now available with grant tracking for nonprofit organizations. Nonprofit organizations are required to submit time records and often reimburse time back to grants. For companies using Grant Tracking in Sage Intacct 2022 R4, this process just got a lot easier with features like the ability to:

- Automate the capture of reimbursable time, with down-to-the-minute precision.

- Receive electronic statements of time spent to satisfy single-audit requirements.

- Continue to use the same user-defined dimensions and user-based roles that you set up in Sage Intacct for your company.

Construction Enhancements

With the release of Sage Intacct 2022 R4, Sage Intacct Construction Payroll is now available to new customers in the Early Adopter program. This new construction-focused payroll functionality allows you to:

In addition, Sage Estimating (SQL Edition) now integrates with Sage Intacct Construction so you can export estimates directly to construction projects without having to re-enter estimate data. Long-established for decades as one of the most powerful construction estimating tools on the market, Sage Estimating features:

Note: Sage Estimating integration is currently available in the Early Adopter program.

- Handle self-performed trade payrolls with ease

- Automate complex payroll calculations and journal entry creation

- Simplify certified payroll reporting in all US states and territories

- Reduce cost overruns and improve the accuracy of future estimates with timely visibility into project labor costs

- Assist with state payroll needs associated with union and non-union organizations

In addition, Sage Estimating (SQL Edition) now integrates with Sage Intacct Construction so you can export estimates directly to construction projects without having to re-enter estimate data. Long-established for decades as one of the most powerful construction estimating tools on the market, Sage Estimating features:

- Seamless integrated workflow from 2D/3D

- Multiple takeoff methods

- Industry standard and industry vertical databases

- Out-of-the-box integration with eTakeoff

Note: Sage Estimating integration is currently available in the Early Adopter program.

Other Notable Enhancements

Sage Intacct 2022 R4 includes a collection of other notable enhancements such as:

Inspired from customer feedback, the Help Center provides a new section on Compliance. Leveraging the experience of global audit experts, we've outlined key compliance areas and provided considerations and guidance to apply to your internal control and reporting procedures.

Now available in the Early Adopter program, new Sage Intacct Lease Accounting functionality enables a seamless transition to the ASC 842 and IFRS 16 lease accounting standards.

For new users, learning your way around Sage Intacct just got easier with Embedded Training located right in the application that delivers product walk-throughs, feature tours, key help links, and more to get you up and running fast.

Inspired from customer feedback, the Help Center provides a new section on Compliance. Leveraging the experience of global audit experts, we've outlined key compliance areas and provided considerations and guidance to apply to your internal control and reporting procedures.

Now available in the Early Adopter program, new Sage Intacct Lease Accounting functionality enables a seamless transition to the ASC 842 and IFRS 16 lease accounting standards.

For new users, learning your way around Sage Intacct just got easier with Embedded Training located right in the application that delivers product walk-throughs, feature tours, key help links, and more to get you up and running fast.

Upgrading to Sage Intacct 2022 R4

The Sage Intacct 2022 R4 release date is November 11, 2022.

This article only covers some of the key highlights of the new release. But be sure to contact us to request a copy of the fully-detailed release notes or if you have questions about upgrading to the latest version.

This article only covers some of the key highlights of the new release. But be sure to contact us to request a copy of the fully-detailed release notes or if you have questions about upgrading to the latest version.