The ability to accept credit card payments is vitally important for most businesses today. That's why Sage Payment Solutions provides a variety of ways to accept and process payments in Sage 300 (formerly Sage Accpac). Adhering to strict PCI compliance rules, Sage Payment Solutions provides your business with the freedom to accept credit cards in person, by mail, over the phone, online, or with your mobile device.

Here's how to process credit card transactions using Sage 300 Payment Processing…

Here's how to process credit card transactions using Sage 300 Payment Processing…

Before You Start ...

Besides having a working internet connection, you must install Sage Exchange on the workstation you are using to process credit cards. Sage 300 Payment Processing uses Sage Exchange to connect your Sage 300 system to Sage Payment Solutions. Sage Exchange transmits and stores credit card details in a PCI-compliant vault, which protects you from exposure to noncompliance penalties and credit card fraud.

Step 1: Create or Select a Document

In Order Entry (O/E) or Accounts Receivable (A/R), create or select a document for which you want to process a credit card payment. Here is a list of Sage 300 screens that support credit card payments:

- A/R Invoice Entry

- A/R Receipt Entry

- O/E Invoice Entry

- O/E Order Entry

- O/E Shipment Entry

Step 2: Set Up a Prepayment or Select a Transaction Type

If you are using Order Entry, Shipment Entry, or Invoice Entry

If you are using A/R Invoice Entry

If you are using A/R Receipt Entry

- Click the Prepayment button

- Create or select a batch for the prepayment

If you are using A/R Invoice Entry

- If you are creating a new document, enter the document details and click Add

- Click the Prepay button

- Create or select a batch for prepayment

If you are using A/R Receipt Entry

- On the Transaction Type list, select Receipt, Prepayment, Unapplied Cash, or Misc. Receipt.

Step 3: Verify the Information

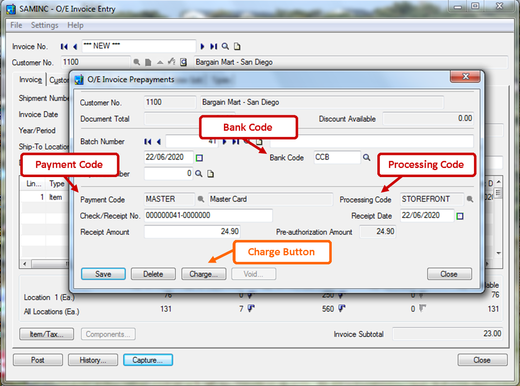

Verify that the Payment Code field displays the correct payment code, or select a payment code that uses the payment type SPS Credit Card.

Tip: Click the Finder to see a list of payment codes and associated payment types.

If you are using the O/E Prepayments screen, verify that the Processing Code field displays the correct processing code, or use the Finder to select a code.

The bank code associated with the processing code appears in the Bank Code field.

Note: The bank and currency for the current transaction must match the bank and currency specified for the processing code you select.

Verify that the Bank Code field displays the correct bank code, or select a bank code to be used when the transaction is processed.

Tip: Click the Finder to see a list of payment codes and associated payment types.

If you are using the O/E Prepayments screen, verify that the Processing Code field displays the correct processing code, or use the Finder to select a code.

The bank code associated with the processing code appears in the Bank Code field.

Note: The bank and currency for the current transaction must match the bank and currency specified for the processing code you select.

Verify that the Bank Code field displays the correct bank code, or select a bank code to be used when the transaction is processed.

Step 4: Enter Remaining Transaction Details

After you enter the remaining transaction details, click the Add button. You'll now notice that the Charge button becomes available.

Step 5: Click Charge

The PMT Process Credit Card screen will then appear. If a default credit card exists in the customer record that uses the processing code selected for the current transaction, that credit card will be selected by default.

Step 6: Specify a Credit Card

- To select a saved credit card, use the Finder.

- To enter details for a new card and save the card in the customer record, click the New button, and then add the card details on the A/R Credit Card Information screen.

- To enter details for a new credit card that will not be saved in the customer record, select Enter a Card for One-Time Use. (You enter card details on the Sage Payment Solutions browser form after you click the Process Pre-authorization button.)

Step 7: Enter or Review Billing Details

These may be different from the information in the Sage 300 customer record. For example, the customer may be using a company credit card, or may be authorized to use a card on behalf of the primary cardholder.

Tip: When entering billing details, you can select the Same as Customer Address option to fill in billing details with name and address information from the customer record.

Tip: When entering billing details, you can select the Same as Customer Address option to fill in billing details with name and address information from the customer record.

Step 8: Review Totals

For some transactions, you can edit the amount in the Taxes field in order to comply with Level 2 processing requirements. When you edit this amount, the amount in the Subtotal field is calculated automatically by subtracting the taxes you entered from the transaction total.

Step 9: Click Process Payment

The Sage Payment Solutions browser form appears.

Step 10: Review or Enter Credit Card Details

If you use a card reader device and did not select a saved credit card for this transaction, you can click Swipe Card to swipe a credit card.

If you want to review these details, click the Next button on the browser form.

If you want to review these details, click the Next button on the browser form.

Step 11: Click Submit.

Sage Payment Solutions will then process the payment, once finished the browser form will close. The transaction details and a status message will then appear on the PMT Process Credit Card screen. Once you finish reviewing the transaction details and status, click Close.

Post or save the document.

And that is how you process a credit card payment in Sage 300!

In summary, Sage Payment Processing is a complete payment processing solution that allows you to securely accept and process credit card transactions directly within Sage 300. Now you can increase your revenue and operational efficiency with a fully integrated payment processing solution.

Post or save the document.

And that is how you process a credit card payment in Sage 300!

In summary, Sage Payment Processing is a complete payment processing solution that allows you to securely accept and process credit card transactions directly within Sage 300. Now you can increase your revenue and operational efficiency with a fully integrated payment processing solution.

Need Sage 300 (Accpac) Support or Training?

Related Articles

Like This Article?

Please feel free to share it with your friends and colleagues!

Like This Article?

Please feel free to share it with your friends and colleagues!