What's New in the Latest Release

Sage Fixed Assets 2021 has been released and is now available for download. Here’s a look at what’s new in the latest version of the powerful fixed asset management software.

UPDATE: What's New in Sage Fixed Assets 2024

UPDATE: What's New in Sage Fixed Assets 2024

Expanded Depreciation Books

In addition to the existing 7 depreciation books in earlier versions of the software, Sage Fixed Assets 2021 adds an additional 13 custom depreciation books in a company. Available in the Sage Fixed Assets – Depreciation Edition, these new books can be used for many purposes such as state tax depreciation, property taxes, historical records, and ADS depreciation.

This was a highly-requested enhancement based on feedback from customers that submitted their suggestions through the Sage City Ideas forum.

This was a highly-requested enhancement based on feedback from customers that submitted their suggestions through the Sage City Ideas forum.

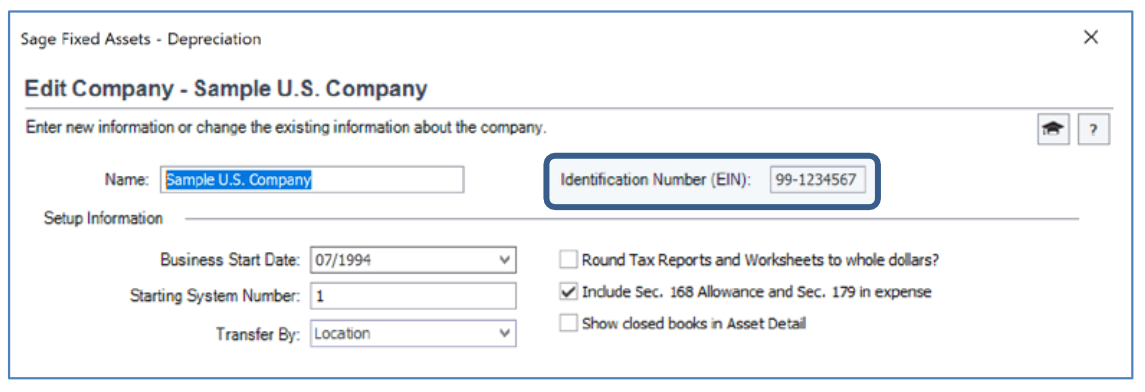

Company EIN Field

Also a highly-requested new feature, the Employer Identification Number (EIN) field is now available in Sage Fixed Assets - Reporting Edition. This field can provide clarity on custom reports when companies with similar names are maintained in Sage Fixed Assets.

Ease of Use Enhancements

A variety of enhancements to existing screens, reports, and other functionality makes Sage Fixed Assets 2021 faster and easier than ever to use.

Adjustable Book Columns in Asset Detail

In the Asset Detail screen, you can now temporarily adjust a book's width to focus on the information most important to you, and then use the new Resize icon to quickly re-distribute all book columns evenly.

Hide Closed Books

You can now choose to hide closed books for each company, allowing you to focus solely on open books. Sage Fixed Assets hides closed books by default.

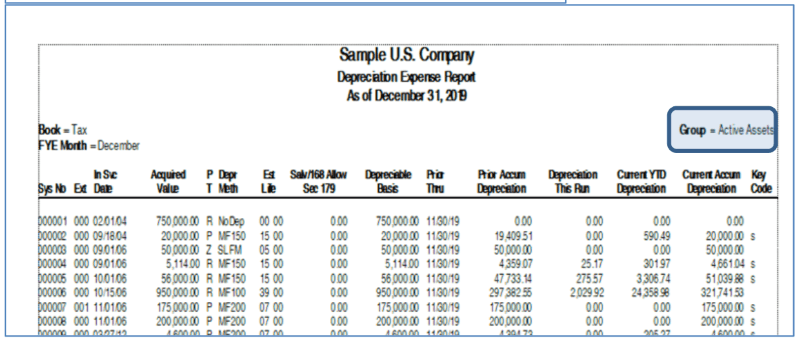

Display Asset Group Name on Select Reports

Another customer-requested enhancement, the Asset Group selected in Report Definition now displays in the header of the Depreciation Expense, Disposal, Transfer, and Fixed Assets Summary reports. This allows you to quickly determine the asset group included in the report.

Adjustable Book Columns in Asset Detail

In the Asset Detail screen, you can now temporarily adjust a book's width to focus on the information most important to you, and then use the new Resize icon to quickly re-distribute all book columns evenly.

Hide Closed Books

You can now choose to hide closed books for each company, allowing you to focus solely on open books. Sage Fixed Assets hides closed books by default.

Display Asset Group Name on Select Reports

Another customer-requested enhancement, the Asset Group selected in Report Definition now displays in the header of the Depreciation Expense, Disposal, Transfer, and Fixed Assets Summary reports. This allows you to quickly determine the asset group included in the report.

Character Count Increases

Book Titles now allow up to 10 characters, reducing the need to use abbreviations. In addition, Project Names in Sage Fixed Assets - Planning Edition now allow up to 32 characters making it easier to differentiate between multiple projects with similar names.

Custom Import Helper Improvements

The Select Fields step of the Custom Import Helper now allows you to select books to filter the displayed Available Fields. In addition, the data preview window is larger. These changes – also requested by customers - make the import process more efficient.

CARES Act Tax Updates

This new release includes tax compliance updates for the Coronavirus Aid, Relief, and Economic Security Act of 2020 (CARES Act).

Book Titles now allow up to 10 characters, reducing the need to use abbreviations. In addition, Project Names in Sage Fixed Assets - Planning Edition now allow up to 32 characters making it easier to differentiate between multiple projects with similar names.

Custom Import Helper Improvements

The Select Fields step of the Custom Import Helper now allows you to select books to filter the displayed Available Fields. In addition, the data preview window is larger. These changes – also requested by customers - make the import process more efficient.

CARES Act Tax Updates

This new release includes tax compliance updates for the Coronavirus Aid, Relief, and Economic Security Act of 2020 (CARES Act).

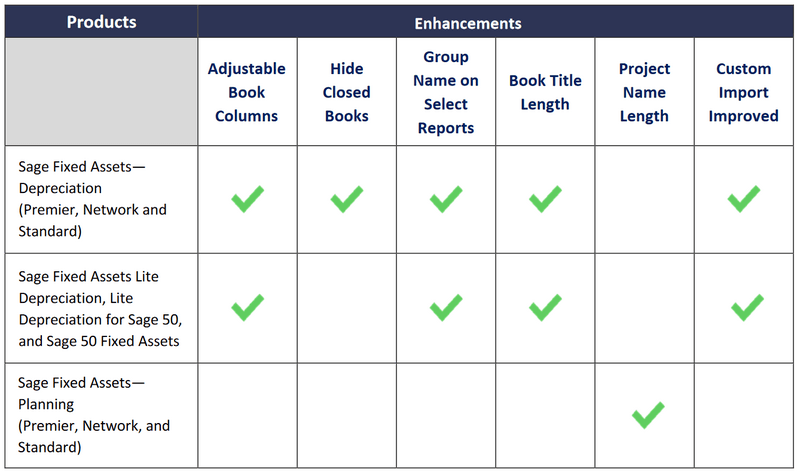

NOTE: Depending on which Sage Fixed Assets product you use, not all of these enhancements apply to your edition. Refer to the grid below to determine which features apply to your product.

Upgrade Notes

As mentioned earlier, not all of these new features will apply to your specific product. In addition, some new features or enhancements are only applicable to Sage Fixed Assets U.S. Edition. Be sure to check with your Sage Authorized Partner for help or with technical questions.