In construction, the process of determining whether your jobs are over billed or under billed each month (or year) has a big impact on the financial statement. If it’s the end of the tax year, it can impact how much you own in taxes, as well.

Overall, the idea of these reports is to review the progress of the job and confirm you’re on track to meet your profit goals. From the accounting standpoint, it’s a way to smooth out the ‘timing’ problems with costs and billing.

Let's explore ...

- Do you have to wait until March or April 15th to know whether you were profitable or not?

- What does 'over billed' or 'under billed' mean anyway, and why is it important when running a construction company?

Overall, the idea of these reports is to review the progress of the job and confirm you’re on track to meet your profit goals. From the accounting standpoint, it’s a way to smooth out the ‘timing’ problems with costs and billing.

Let's explore ...

Creating the Progress Bill

When a progress bill is put together, the project managers (PM) are often projecting how far they’ll be by the end of the month. This includes:

Sometimes this estimate is done 5, 10, or even 15 days before the end of the month.

Then reality steps in ... the crew didn’t make the production rate; the materials weren’t delivered on time; the subcontractor didn’t get as far as expected; the weather was uncooperative; or maybe you blew past all the estimates and got way further than expected!

- What size crews they're scheduling

- What materials will be on the site and/or 'in the wall'

- What subcontractors are expected and when they say they’ll start or finish their work

Sometimes this estimate is done 5, 10, or even 15 days before the end of the month.

Then reality steps in ... the crew didn’t make the production rate; the materials weren’t delivered on time; the subcontractor didn’t get as far as expected; the weather was uncooperative; or maybe you blew past all the estimates and got way further than expected!

|

Sage 100 Contractor has an out-of-the-box report to track over/under billing. If your company has lots of jobs or needs specific reporting parameters, you should check out this Sage 100 Contractor add-on. This fully integrated program will speed up the process and provide you with more flexibility.

|

The Plan Versus Reality

The Over/Under billing review compares what expenses actually hit in the month compared to the budgeted expenses for the project (including approved change orders). What percent of the budget has been used? Strictly doing the math indicates what percent of the contract you would have earned.

Now you need the PM’s to weigh in. Is the calculated percent complete (costs versus budget) a true reflection of how the job is going? Does it say 85% complete, but due to overruns or problems, the job is really 75% complete? Or, does it say 90% complete but they’re actually done and it came in under budget?

Don’t change the budgets, BTW; this is not the way to handle this. And don’t waste time entering internal change orders. Print the report to Excel and carefully make adjustments.

Be careful: the PM may say they’ll be ahead of budget, but if the job isn’t very far along, a lot can happen. Better to be conservative than to have to explain reduced profit a few months from now.

When you compare that to the actual billing to-date, you are either:

See Also: Why Contractors are Replacing Paper Timesheets with Mobile Devices

Now you need the PM’s to weigh in. Is the calculated percent complete (costs versus budget) a true reflection of how the job is going? Does it say 85% complete, but due to overruns or problems, the job is really 75% complete? Or, does it say 90% complete but they’re actually done and it came in under budget?

Don’t change the budgets, BTW; this is not the way to handle this. And don’t waste time entering internal change orders. Print the report to Excel and carefully make adjustments.

Be careful: the PM may say they’ll be ahead of budget, but if the job isn’t very far along, a lot can happen. Better to be conservative than to have to explain reduced profit a few months from now.

When you compare that to the actual billing to-date, you are either:

- Under Billed - got more done that you estimated or were allowed to bill. Or ...

- Over Billed - didn’t get as far as you expected.

See Also: Why Contractors are Replacing Paper Timesheets with Mobile Devices

Over or Under Billed: The Bottom Line

Being Over Billed is not bad. In fact, it helps your cash flow.

Being Under Billed is not bad either, but it can adversely impact cash if it keeps happening.

Remember, they’re holding retention, so you won’t have all that cash as it is. You need to pay those suppliers if you’re going to get the waivers you need, so a little over billed is not bad at all, if you can get it.

Being Under Billed is not bad either, but it can adversely impact cash if it keeps happening.

Remember, they’re holding retention, so you won’t have all that cash as it is. You need to pay those suppliers if you’re going to get the waivers you need, so a little over billed is not bad at all, if you can get it.

BROUGHT TO YOU BY SYSCON

This guest article, written by Catherine Wendt, was provided by Syscon. With over 35 years of industry experience under their belts, Syscon has learned a few things about what construction companies need and want when it comes to technology.

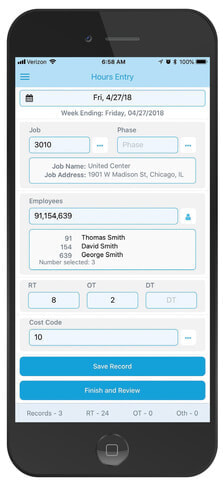

Syscon is also the maker of the popular Field Integrated Integrated Time system (F.I.T.) that leverages the cloud and mobile devices to save your company time and money, while reducing the challenge and frustration of collecting time from the field |