WHAT'S NEW IN THE LATEST VERSION

Sage 300 2021 (and Sage 300cloud 2021) was released on September 14, 2020. Here’s a look at what’s new in this latest version that includes a range of new features to streamline workflow along with security enhancements to keep your data safe.

UPDATE: Since the original posting of this article, three subsequent releases of Sage 300 2021 have been released including:

Scroll to the end of this article for new features and enhancements introduced in those latest releases as of October 2021.

- Product Update 1 (aka Version 2021.1)

- Product Update 2 (Version 2021.2)

- Product Update 3 (Version 2021.3)

Scroll to the end of this article for new features and enhancements introduced in those latest releases as of October 2021.

UPDATE: Sage 300 2024 was released September 18, 2023. Click to check out new features in the latest release!

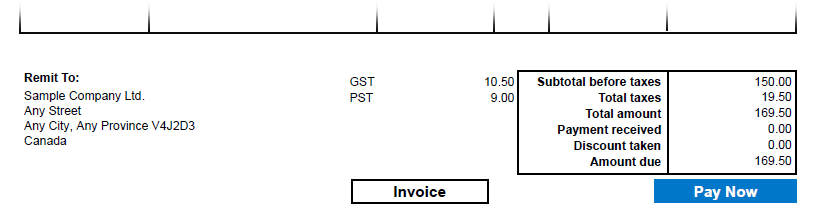

Send Invoices and Accept Payments Faster

Sage has partnered with both PayPal and Stripe to help you process payments even faster and easier. With this new capability that’s built directly into Sage 300cloud 2021, you can add a Pay Now link to your invoices, bringing the same online payment convenience that customers and consumers have come to expect.

Payments made using this new 300cloud e-invoicing feature will automatically create AR entries in your ERP software which saves you time and reduces errors. In addition, customer payments via “Pay Now” will be remitted to your business account with the payment providers’ fees recorded as a bank entry to record the expense in Sage 300. This will be a HUGE time-saver, especially for Sage customers that are currently using a 3rd party application to process electronic invoices, some of which require manual updates to record payments in Sage 300.

Refer to these instructions for detailed guidance on connecting to a provider and accepting electronic payments.

Note: This new feature is available in Sage 300cloud only.

Payments made using this new 300cloud e-invoicing feature will automatically create AR entries in your ERP software which saves you time and reduces errors. In addition, customer payments via “Pay Now” will be remitted to your business account with the payment providers’ fees recorded as a bank entry to record the expense in Sage 300. This will be a HUGE time-saver, especially for Sage customers that are currently using a 3rd party application to process electronic invoices, some of which require manual updates to record payments in Sage 300.

Refer to these instructions for detailed guidance on connecting to a provider and accepting electronic payments.

Note: This new feature is available in Sage 300cloud only.

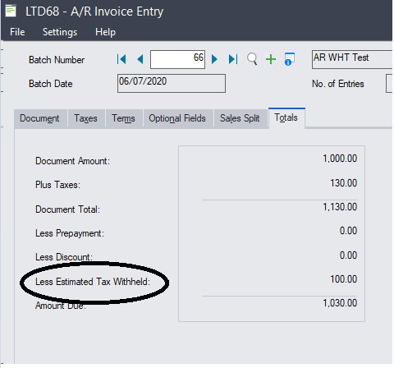

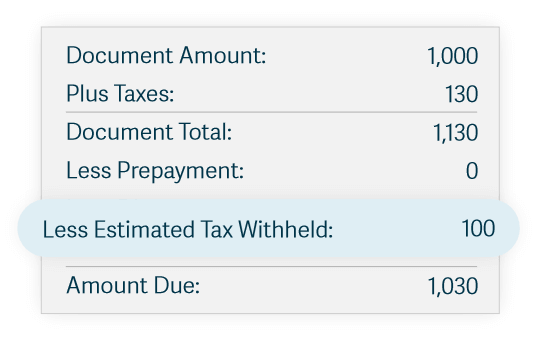

Tax Withholding for Sales Transactions

In addition to the ability to withhold taxes for purchases (a feature that was rolled out last year), this new capability in Sage 300 2021 enables you to withhold sales tax at the point of sale and record those transactions as needed. This is very helpful for customers who do business in different tax jurisdictions with these tax withholding requirements.

You can withhold some or all of the tax amount – which can be calculated based on the sales price or as a flat amount per transaction.

Note: This new feature is available in Sage 300cloud only.

You can withhold some or all of the tax amount – which can be calculated based on the sales price or as a flat amount per transaction.

Note: This new feature is available in Sage 300cloud only.

Sage 300cloud Web Screen Updates

If you’ve been using Sage 300 for a while, you already know that each release continues to enhance the newer Sage 300cloud web screens and Sage 300 2021 is no exception. Here’s a look at what’s new:

Text Size Control - A new Text Size setting gives you better control over the size of text on web screens. As an example, sometimes using smaller text allows you to see more fields and controls without having to scroll down the page.

Specify Bill of Material (BOM) Numbers - For transactions created from scratch in the O/E Shipment Entry or O/E Credit/Debit Note Entry screens (that is, a shipment not created from an order, or a credit/debit note not created from an invoice), you can now specify a Bill of Material (BOM) number in the Kit/BOM field when entering details.

Customize Report Printing - In Sage 300cloud web screens, you can have a maximum of ten screens open at a time. By default, each printed report you have open counts toward this limit of ten screens – but with these new controls, you can now customize web screens so that printed reports do not count toward the limit.

As a refresher, web screens run in parallel with the classic Sage 300 desktop screens, so there's no need to choose between desktop or web. Everyone in your organization can use the interface that best suits their needs, while working seamlessly with a single shared set of company data. For more information, refer to our Sage 300 Web Screens FAQs.

See Also: What's New in Sage 300 2020

Text Size Control - A new Text Size setting gives you better control over the size of text on web screens. As an example, sometimes using smaller text allows you to see more fields and controls without having to scroll down the page.

Specify Bill of Material (BOM) Numbers - For transactions created from scratch in the O/E Shipment Entry or O/E Credit/Debit Note Entry screens (that is, a shipment not created from an order, or a credit/debit note not created from an invoice), you can now specify a Bill of Material (BOM) number in the Kit/BOM field when entering details.

Customize Report Printing - In Sage 300cloud web screens, you can have a maximum of ten screens open at a time. By default, each printed report you have open counts toward this limit of ten screens – but with these new controls, you can now customize web screens so that printed reports do not count toward the limit.

As a refresher, web screens run in parallel with the classic Sage 300 desktop screens, so there's no need to choose between desktop or web. Everyone in your organization can use the interface that best suits their needs, while working seamlessly with a single shared set of company data. For more information, refer to our Sage 300 Web Screens FAQs.

See Also: What's New in Sage 300 2020

Sage 300 2021 Video Overview

Other Notable Updates in Sage 300 2021

Here’s a quick rundown of a few other new features or enhancements that are worth noting:

Longer Numbers for Checks and Deposit Slips - you can now enter check and/or deposit slip numbers that are up to fifteen characters long (except in Sage 300 Payroll, where check numbers can be up to nine characters long).

Specify Customer Account Sets in O/E Templates - you can now specify customer account sets in Order Entry templates.

Stronger Default Security - When you install Sage 300 2021 new (rather than upgrading from a previous version), security is turned on by default. User passwords must include both letters and numbers, and be at least 8 characters long.

Sage 300 Payroll (U.S.) - when setting up federal income tax for an employee, you can now indicate if the employee is a Non-Resident Alien. This release also includes legislative updates for several states and local jurisdictions.

Bank Services – when you reverse a payment (using Bank Reverse Transactions screen) that includes withheld tax amounts, the offsetting tax tracking record and offsetting update to 1099/CPRS statistics are created.

Longer Numbers for Checks and Deposit Slips - you can now enter check and/or deposit slip numbers that are up to fifteen characters long (except in Sage 300 Payroll, where check numbers can be up to nine characters long).

Specify Customer Account Sets in O/E Templates - you can now specify customer account sets in Order Entry templates.

Stronger Default Security - When you install Sage 300 2021 new (rather than upgrading from a previous version), security is turned on by default. User passwords must include both letters and numbers, and be at least 8 characters long.

Sage 300 Payroll (U.S.) - when setting up federal income tax for an employee, you can now indicate if the employee is a Non-Resident Alien. This release also includes legislative updates for several states and local jurisdictions.

Bank Services – when you reverse a payment (using Bank Reverse Transactions screen) that includes withheld tax amounts, the offsetting tax tracking record and offsetting update to 1099/CPRS statistics are created.

Sage 300 2021.1 and 2021.2 Product Updates

Click to expand the box below for details on new features and product enhancements introduced with the release of product update 1 (aka v2021.1) and product update 2 (aka v2021.2) for Sage 300 2021 :

What's New in Sage 300 2021.1 (PRODUCT UPDATE 1)

Updated 1099 tax reporting

For tax year 2020, Nonemployee Compensation is reported in box 1 on a new 1099-NEC form (instead of box 7 on the 1099-MISC form where it was reported previously). On the A/P Print 1099/1096 Forms screen, you can now print to the new 1099-NEC form, as well as updated versions of the 1099-MISC and 1096 forms.

Improved 1099/CPRS codes

1099/CPRS codes no longer correspond to specific box numbers on forms, because these box numbers may change from year to year (which has happened with several boxes in tax year 2020, including the change to Nonemployee Compensation discussed above).

Instead of using the code as an indication of the box number where amounts should be reported, for each code you now specify a type of payment (or other amount) to be reported on 1099/CPRS forms. When you print a form for a specific tax year, amounts are automatically printed in the correct boxes for that year.

To continue using your existing 1099/CPRS codes, update each of them by specifying a tax reporting type (1099 or CPRS) and an amount type. Also, consider creating 1099/CPRS codes with meaningful names for your next reporting cycle (for example, if you currently use code 7 for Nonemployee Compensation, you might replace this code with one named NEC). If you create new codes, ensure that you assign them to vendors in Accounts Payable.

For tax year 2020, Nonemployee Compensation is reported in box 1 on a new 1099-NEC form (instead of box 7 on the 1099-MISC form where it was reported previously). On the A/P Print 1099/1096 Forms screen, you can now print to the new 1099-NEC form, as well as updated versions of the 1099-MISC and 1096 forms.

Improved 1099/CPRS codes

1099/CPRS codes no longer correspond to specific box numbers on forms, because these box numbers may change from year to year (which has happened with several boxes in tax year 2020, including the change to Nonemployee Compensation discussed above).

Instead of using the code as an indication of the box number where amounts should be reported, for each code you now specify a type of payment (or other amount) to be reported on 1099/CPRS forms. When you print a form for a specific tax year, amounts are automatically printed in the correct boxes for that year.

To continue using your existing 1099/CPRS codes, update each of them by specifying a tax reporting type (1099 or CPRS) and an amount type. Also, consider creating 1099/CPRS codes with meaningful names for your next reporting cycle (for example, if you currently use code 7 for Nonemployee Compensation, you might replace this code with one named NEC). If you create new codes, ensure that you assign them to vendors in Accounts Payable.

WHAT'S NEW IN SAGE 300 2021.2 (PRODUCT uPDATE 2)

New Web Screens

Each new release migrates more of the “traditional” desktop screens over to the newer and more modern web screens. Here are some of the web screens added in product update 2:

General Ledger Web Screens

Includes Account History Inquiry, Budget Maintenance, and Source Currency Inquiry.

Accounts Receivable Web Screens

Includes new web screens for Receipt Inquiry and Refund Inquiry.

New Users Web Screens

New screen used to add and manage user records.

General Ledger Web Screens

Includes Account History Inquiry, Budget Maintenance, and Source Currency Inquiry.

Accounts Receivable Web Screens

Includes new web screens for Receipt Inquiry and Refund Inquiry.

New Users Web Screens

New screen used to add and manage user records.

Usability Enhancements

Usability enhancements make Sage 300 easier to use as well as find or enter data more quickly. Available on many web screens, the newly-redesigned Finder function improves search filtering and makes it easier to scan through larger transaction results.

For those power users who prefer to keep their hands on the keyboard, new keyboard shortcuts in web screens have been added including Alt + Down Arrow to open the Finder function and the Esc key to close the Finder.

Lastly, Sage 300 2021 Product Update 2 delivers an improved process for printing reports. Now when printing reports from a report screen or home page widget, the Export Report screen appears in a new browser tab and provides options for saving the report to a file. To print a physical copy of the report, save the file to a PDF and then print.

For those power users who prefer to keep their hands on the keyboard, new keyboard shortcuts in web screens have been added including Alt + Down Arrow to open the Finder function and the Esc key to close the Finder.

Lastly, Sage 300 2021 Product Update 2 delivers an improved process for printing reports. Now when printing reports from a report screen or home page widget, the Export Report screen appears in a new browser tab and provides options for saving the report to a file. To print a physical copy of the report, save the file to a PDF and then print.

New Integration with Data Analytics Tool

Through a strategic partnership, Sage announced the launch of Sage Data & Analytics - a modern business intelligence (BI) and data management platform that’s now available and integrated with Sage 300 2021.2.

Check out our full article covering the new Sage Data & Analytics product.

Check out our full article covering the new Sage Data & Analytics product.

What's New in Sage 300 2021.3 (Product Update 3)

Improvement to Bank Feeds

On the Reconcile E-Statements screen when automatically reconciling transactions from a bank feed, Sage 300 now tries to match transactions in more ways than it did previously.

Transactions will now match if certain information in Sage 300 is in the Comment 2 field in the e-statement, even if the Comment 2 field includes additional information (for example, if the payment description in Sage 300 is Check 900 and the Comment 2 field in the e-statement is Invoice 2286 Goods - Check 900).

In addition, transactions downloaded using a bank feed now have a Bank Cleared Date based on your local time.

See Sage 300 Bank Feeds for more information on this relatively new feature.

On the Reconcile E-Statements screen when automatically reconciling transactions from a bank feed, Sage 300 now tries to match transactions in more ways than it did previously.

Transactions will now match if certain information in Sage 300 is in the Comment 2 field in the e-statement, even if the Comment 2 field includes additional information (for example, if the payment description in Sage 300 is Check 900 and the Comment 2 field in the e-statement is Invoice 2286 Goods - Check 900).

In addition, transactions downloaded using a bank feed now have a Bank Cleared Date based on your local time.

See Sage 300 Bank Feeds for more information on this relatively new feature.